Exploring the World of Trading Types, Strategies, and Platforms Trading is a Fundamental conception in the world of finance and investing. It involves the buying and selling of fiscal instruments, similar to stocks, bonds, goods, currencies, and derivations, with the end of making a profit. Trading can take place on colorful platforms, including stock exchanges, untoward requests, and electronic trading systems. In this composition, we will claw into the complications of trading, exploring its different types, crucial actors, strategies, and how it operates.

Understanding Trading

Description of Trading

Trading refers to the act of swapping fiscal instruments between buyers and merchandisers in order to subsidize price oscillations. It involves making informed opinions grounded on request analysis, profitable pointers, and other applicable factors.

Objects of Trading

Dealers engage in Trading with different objects, including capital appreciation, income generation through tips or interest, hedging against threats, and assuming unborn price movements.

Types of Trading

- Stock Trading Buying and dealing shares of intimately traded companies.

- Forex Trading Trading currencies in the foreign exchange request.

- Commodity Trading Trading physical goods like gold, oil painting, or agrarian products.

- Bond Trading Buying and dealing fixed-income securities.

- Options Trading Trading contracts that give the right, but not the obligation, to buy or sell means at a destined price.

Participants in Trading

Retail Traders

Individual dealers who trade with their own capital through brokerage accounts.

Institutional Dealers

Banks, barricade finances, collective finances, and other fiscal institutions that trade on behalf of their guests or manage their own portfolios.

Market Makers

Realities that give liquidity to the request by quoting both buy and vend prices for a particular instrument.

Brokers

interposers who grease trades by executing orders on behalf of guests. They may charge a commission or spread for their services.

How Trading Works

Trading works through a series of ways and processes that enable buyers and merchandisers to change fiscal instruments. Then’s a detailed explanation of how trading works

Financial Instruments

Trading involves colorful fiscal instruments, similar to stocks, bonds, goods, currencies, and derivations. Each instrument represents a specific value and is traded in its separate request.

Marketplaces

Trading takes place in different commerce, including stock exchanges, over-the-counter( OTC) requests, and electronic trading platforms. This commerce gives a platform for buyers and merchandisers to interact and execute trades.

Participants

Trading involves colorful actors, including retail dealers, institutional dealers, request makers, and brokers. Each party plays a specific part in the trading process.

Placing Orders

Dealers place orders to buy or vend fiscal instruments. There are different types of orders, similar to request orders, limit orders, and stop orders.

- Request Orders Dealers place request orders to buy or vend an asset at the prevailing request price. The order is executed incontinently at the stylish available price.

- Limit Orders Dealers specify the maximum price they’re willing to pay when buying or the minimal price they anticipate to admit when dealing. The order will only be executed if the request reaches the specified price.

- Stop Orders Dealers use stop orders to limit implicit losses or cover gains. A stop-loss order is touched off when the price reaches a specified position, limiting the dealer’s loss. A stop-limit order combines a stop order with a limit order to control the price at which the order is executed.

Execution

Once an order is placed, it’s executed through colorful mechanisms. In the case of exchange-traded instruments, the order is matched with a counterparty on the exchange. request makers also play a part in furnishing liquidity by quoting both buy and vend prices.

Clearing and Settlement

After the prosecution of a trade, the clearing and agreement process takes place. Clearing involves vindicating the trade details, while agreement involves the transfer of power and finances. This process ensures that both parties fulfill their scores and complete the trade.

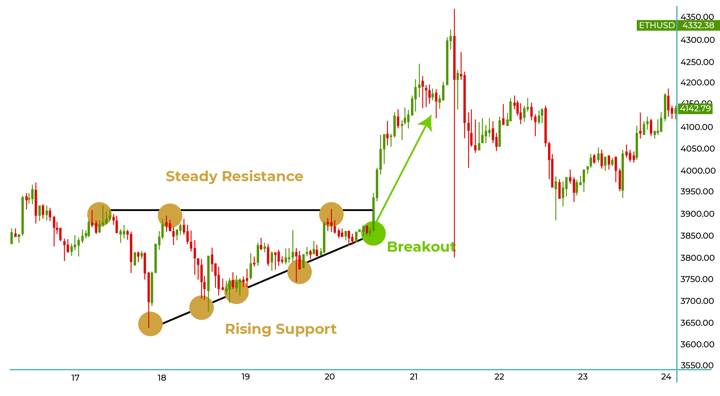

Market Analysis

Dealers dissect colorful factors to make informed trading opinions. This includes conducting specialized analysis by studying price patterns, trends, and pointers on maps. Abecedarian analysis involves assessing the fiscal health and prospects of companies or husbandry grounded on factors similar to earnings, fiscal statements, and macroeconomic pointers.

Trading Strategies

Dealers borrow different strategies grounded on their objects and threat forbearance. Some common trading strategies include day trading, swing trading, trend following, value investing, and arbitrage. These strategies help dealers identify openings and manage pitfalls.

Risk Management

Successful dealers employ threat operation ways to cover their capital. This includes setting stop-loss orders to limit implicit losses, diversifying their portfolios to spread threats, and managing position sizes to control exposure.

Technology

Trading has become decreasingly reliant on technology. Electronic trading platforms give real-time request data, order placement, and logical tools. Algorithmic trading, using computer programs to execute trades grounded on predefined strategies, has gained fashionability as well.

Regulatory Framework

Trading conditions are subject to nonsupervisory fabrics set by government agencies and fiscal authorities. These regulations aim to ensure fair and transparent trading practices, cover investors, and maintain request integrity.

Trading involves the exchange of fiscal instruments between buyers and merchandisers through colorful commerce and platforms. It requires placing orders, executing trades, and managing pitfalls. By assaying requests, employing trading strategies, and exercising technology, dealers aim to benefit from price movements and achieve their trading objectives.

Trading Platforms

Trading platforms play a pivotal part in easing the buying and selling of fiscal instruments. They give dealers the necessary tools and structure to execute trades, access request data, and manage their portfolios. Then are some common types of trading platforms

Stock Exchanges

Stock exchanges are formal commerce where dealers can buy and vend stocks and other securities. exemplifications include the New York Stock Exchange( NYSE), London Stock Exchange( LSE), and Tokyo Stock Exchange( TSE). These exchanges have specific trading hours and give a centralized platform for trading listed securities.

Over-the-Counter( OTC) Markets

OTC requests relate to decentralized trading platforms where fiscal instruments are traded directly between buyers and merchandisers, without the involvement of a centralized exchange. OTC requests are common for certain stocks, bonds, and derivations. request actors can negotiate prices and terms directly with each other or through brokers.

Electronic Communication Networks( ECNs)

ECNs are electronic trading platforms that connect buyers and merchandisers directly. They give a venue for trading stocks, currencies, and other fiscal instruments. ECNs allow for anonymous trading and frequently offer lower sale costs compared to traditional exchanges. Nasdaq’s electronic trading platform is an illustration of an ECN.

Online Brokerage Platforms

Online brokerage platforms are web-grounded platforms handed by brokerage enterprises. These platforms allow individual dealers to place orders, access request data, and manage their accounts online. They frequently offer a wide range of fiscal instruments, including stocks, bonds, options, and exchange-traded finances( ETFs). exemplifications of online brokerage platforms include TD Ameritrade, E-Trade, and Interactive Brokers.

Forex Trading Platforms

Forex trading platforms are specifically designed for trading currencies in foreign exchange requests. These platforms give real-time currency quotations, charting tools, and order prosecution capabilities. Popular forex trading platforms include MetaTrader, cTrader, and TradingView.

Futures and Options Trading Platforms

Futures and options trading platforms are specialized platforms for trading derivative contracts. They allow dealers to engage in secondary trading, which involves buying or dealing contracts grounded on the unborn price of a beginning asset. exemplifications of futures and options trading platforms include CME Group’s Globex platform and the Options Clearing Corporation’s OCC Platform.

Mobile Trading Apps

With the advancement of technology, numerous trading platforms offer mobile operations( apps) that enable dealers to pierce the requests and manage their trades on smartphones and tablets. These apps give real-time quotations, order placement, and regard operation features. Popular mobile trading apps include Robinhood, E * TRADE, and Fidelity.

Algorithmic Trading Platforms

Algorithmic trading platforms, also known as automated trading systems, enable dealers to execute trades grounded on predefined rules and algorithms. These platforms use computer programs to dissect request data, identify trading openings, and automatically execute trades. Examples include MetaTrader’s Expert counsels and personal trading platforms developed by fiscal institutions.

Each trading platform may have its own features, stoner interface, and figure structures. Dealers should consider factors similar to trustability, security, ease of use, vacuity of trading instruments, and client support when opting for a trading platform that stylishly suits their requirements.

Trading platforms give the necessary structure for dealers to buy and sell fiscal instruments. Whether it’s stock exchanges, OTC requests, online brokerage platforms, or technical trading platforms, these platforms enable dealers to pierce the requests, execute trades, and manage their portfolios efficiently. The choice of a trading platform depends on the specific conditions and preferences of individual dealers.

Conclusion

Trading plays a vital part in fiscal requests, allowing actors to buy and sell colorful fiscal instruments to benefit from price movements. By understanding the different types of trading, crucial actors, and trading strategies, individuals can make informed opinions and navigate the complications of the trading world. still, it’s important to flashback that trading involves pitfalls, and aspiring dealers should acquire knowledge, develop chops, and exercise caution to increase their chances of success.